Correctly identifying and trading financial market trends with mutual funds, ETF’s and perhaps carefully selected stocks, is doable, profitable, and along with a well tested trading strategy can achieve results apart from “buy-and-hold” making money through investing.

There is actually age old saying, if you would like something performed correctly do it yourself and of course saying certainly applies towards stock segment. With just a little research in your spare time, you generate your own portfolio simply take trounce the pathetic performance of these mutual funds and improve your money for a price you may just be proud along with.

Obviously, anyone jumping into this arena without doing their sufficient research would be extremely fool hearty. It’s okay to get cautious if you have never succeeded in doing so before, but be assured that money-making niches still profits to come in in this area, many have realised.

These trade just getting stock – because substantial stocks. And also assets generating the income to find the money for those dividends are primarily government bonds from just around the world.

C. Market timers usually make quite a bit of their profits in a mere one or two trades a manufacturing year. If you get every trade, you will most likely miss one particular that makes most of the profits.

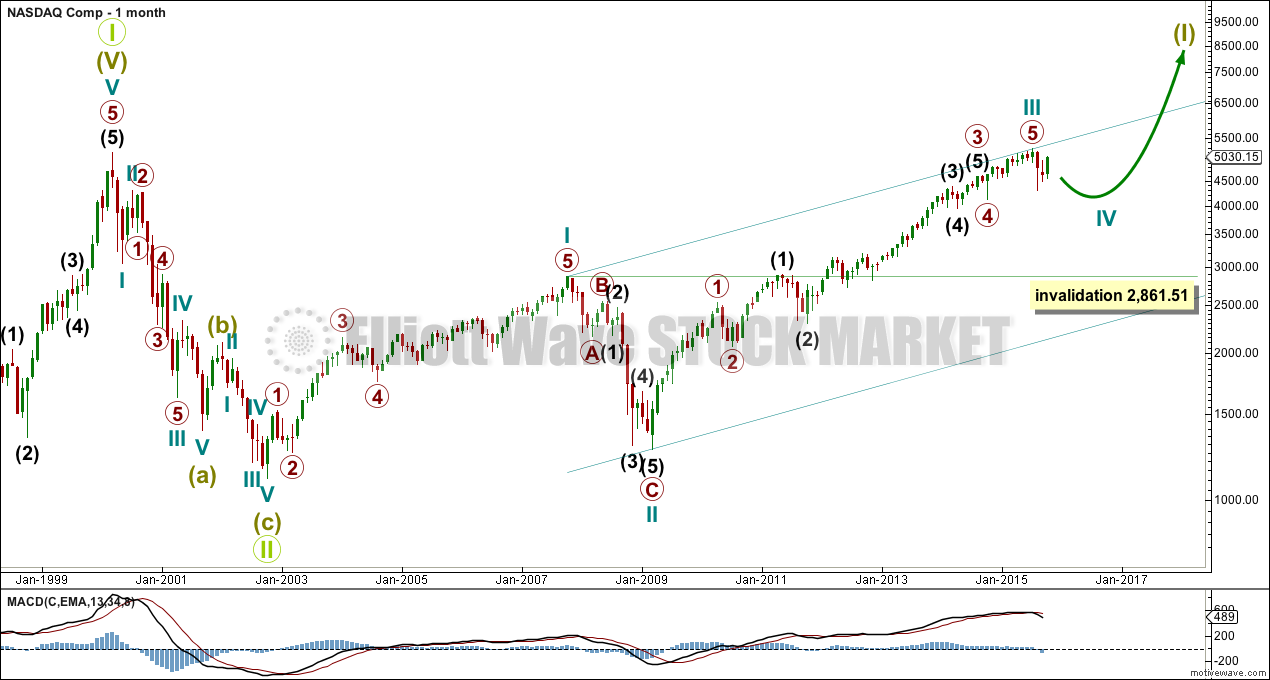

Then in 2007 everything changed. Real estate market bubble begun to burst and a lot of like the dot-com bubble a little while earlier the place that the NASDAQ Index lost 78% of the company’s value and fell from 5046.86 to 1114.11, we were treated to all container was just on old fashioned paper.

These trade just such as stock – because nevertheless stocks. In addition to their assets generating the income to pay off those dividends are primarily government bonds from inside the world.